Clare hoteliers have welcomed comments today by Minister for Tourism Catherine Martin, TD, that she will continue to seek a further extension of the 9% VAT rate for the tourism and hospitality sector in Ireland.

The tourism VAT rate, which is due to expire at the end February, is currently under review by the cabinet. In light of the growing economic challenges facing the sector, local hoteliers are urging the Government to retain the existing 9% rate to safeguard tourism livelihoods and secure the long-term, sustainable development of Irish tourism.

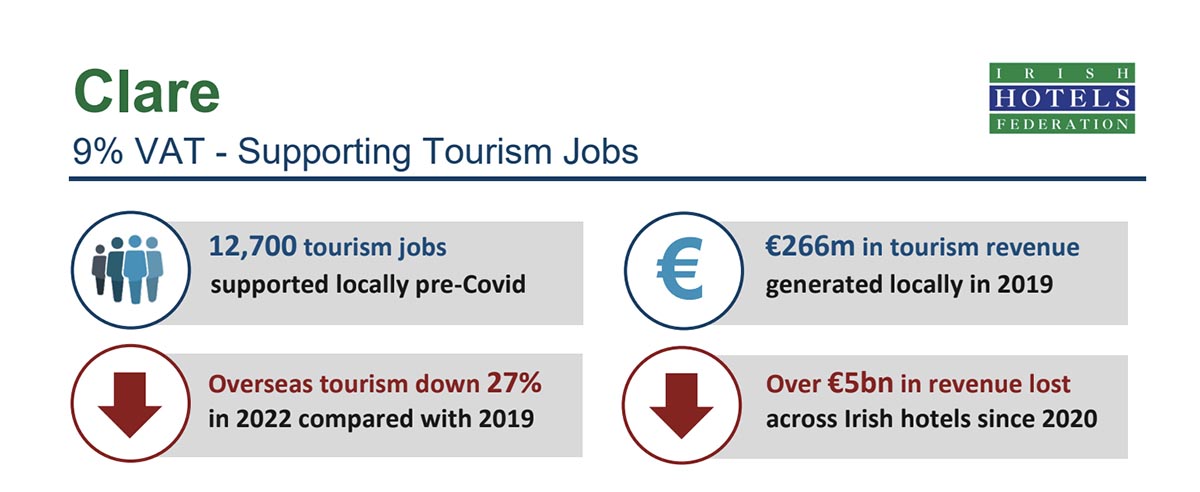

The industry is at a critical juncture with consumer confidence reaching decade lows across key markets as it grapples with a cost-of-living crisis, record levels of inflation, interest rate hikes, skyrocketing business costs and a global economy that is edging towards recession Tourism businesses are collectively Ireland’s largest indigenous employer. Prior to the pandemic, the tourism industry supported over 270,000 livelihoods nationally, including some 12,700 jobs throughout Clare, generating €266m in tourism revenues annually for the local economy.

With a full recovery in tourism now likely to be delayed until 2026, an increase in the VAT rate to 13.5% is the last thing that should be contemplated given its inflationary impact and the damage it would cause to Ireland’s tourism competitiveness. This would result in Irish consumers and overseas visitors having to pay the third highest tourism VAT rate in all of Europe.

Against this backdrop, hotels and guesthouses are urging the Government to retain the 9% VAT rate at its current rate.