The Residential Zoned Land Tax is a new tax aimed at increasing housing supply by activating zoned, serviced residential development lands (including mixed-use lands) for housing.

This can include greenfield and brownfield land which will be subject to tax from 2024. The introduction of the tax is a commitment under Housing for All – A New Housing Plan for Ireland, the Government’s housing plan to 2030.

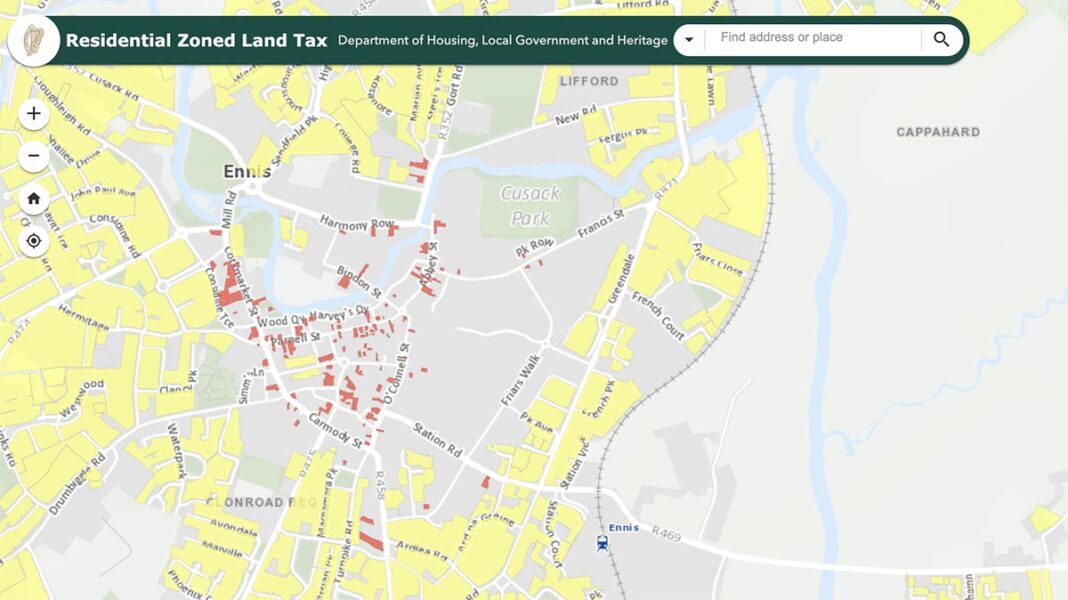

The RZLT Draft Map is now available to view on the Clare County Council website and at its public offices and libraries. The Draft Map identifies zoned and serviced lands that will be subject to the new Residential Zoned Land Tax. Clare County Council is advising members of the public, including landowners and third parties, that they have until 1st January 2023 to check the lands included on the Draft Map and to make submissions.

Submissions can be made to Clare County Council indicating whether or not land on the map meets the criteria for being subject to the tax (see the Council’s website for relevant criteria). Submissions can:

- Request a correction to the Residential Zoned Land Tax Draft Map if they feel that the land included on the map does not meet the criteria, or they disagree with the date on which the land met the criteria;

- Landowners can request a change of zoning of their land so that it is not subject to the tax;

- Identify other land that has not been included in the Draft Map and that they consider meets the relevant criteria and should be subject to the tax.

Urging people to check the Draft Map, Liam Conneally, Director of Economic Development at Clare County Council, said: “I would urge members of the public to examine the Draft Map published on Clare County Council’s website and, if required, make a submission to the process before 1st January, 2023. County Clare needs increased housing supply to meet our housing needs and the new residential zoning land tax aims to incentivise landowners to develop housing on serviced lands zoned for housing, i.e. on land with planning permission and land without.”

The Residential Zoned Land Tax is an annual tax, which will be first due in 2024 in respect of lands included on the RZLT Final Map to be published by local authorities on 1st December, 2023. The Residential Zoned Land Tax will apply annually at a rate of 3% of the market value of the land. The tax will be administered by the Revenue Commissioners on a self-assessment basis.

Homeowners will not have to pay the Residential Zoned Land Tax if they own a residential property which appears on the local authorities’ Residential Zoned Land Tax Maps, but which is subject to the Local Property Tax (LPT).

Clare County Council’s Draft Map can be viewed on its website or by clicking here or at its public offices and libraries.

More information on the measure can also be found at: http://www.gov.ie/rzlt.